Cash Pool

Multi-company balance consolidation

Cash concentration

Multi-company balance consolidation

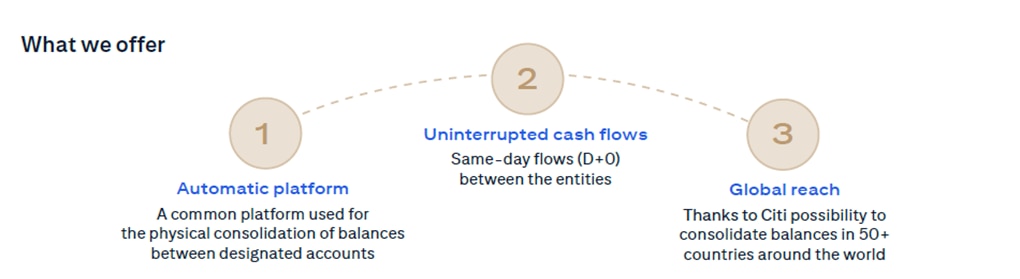

The management of surpluses and flows within a company or a group can be more effective with appropriate balancing structures. The automatic consolidation of balances is a solution that ensures the physical concentration of funds on accounts in the group regardless of location. This allows to optimize liquidity and achieve benefits in the form of interest.

- End of day (EOD) transfers without loss of value date (D+0)

- Available as zero-balancing or target-balancing

- Optional interest allocation service enables calculation and booking of interest as well as monitoring of sweeps and the intra-group position of the participants

- Possibility to add different currencies to separate structures

- Support from an experienced team of experts

Cross border Cash Pool posibilites (Target Balancing)

- ✔ Fully automated global platform to physically concentrate balances from designated source accounts into a concentration header

- ✔ Possibility to create separate structures for different currencies

- ✔ Availability of customized reports