QUICK CASH

Wake up your cash from winter dream!

Transfer your unused limit to your account.

Pay in installments at your convenience.

#InYourCard

- Home

- Loans and Credits

- Quick Cash

Money to hand?

It just waiting for the transfer!

#YouHaveitInTheCard

Transfer funds from the limit of your Credit Card and repay the cash in convenient installments. Immediately, without a request. You can take Quick Cash by yourself without contacting an advisor.

How can you use these funds?

How to use it?

-

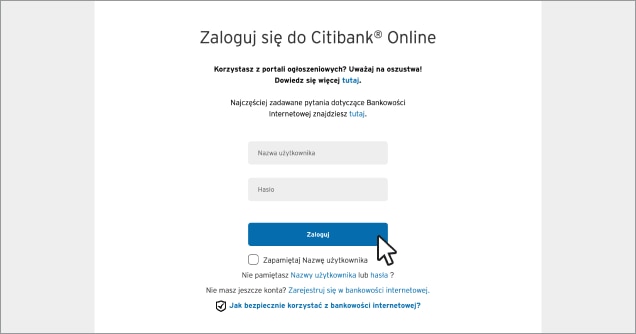

1. You log in to Citibank Online.

-

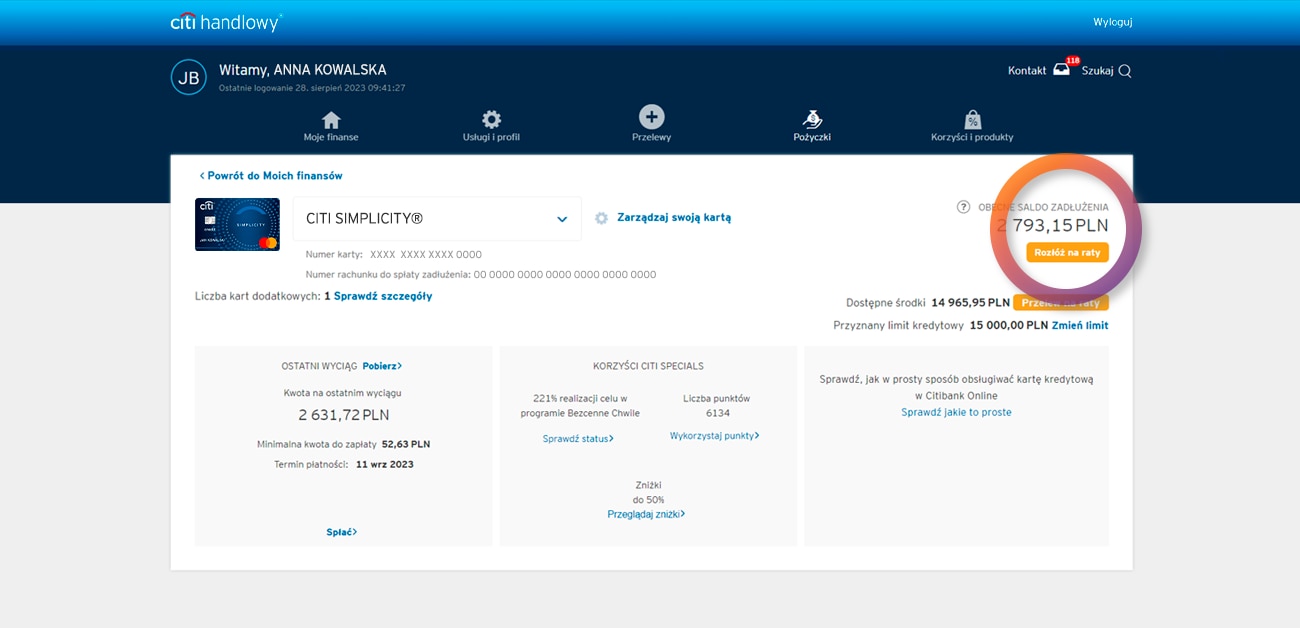

2. After going to the Credit Card section, select "Quick Cash"

You will be redirected to the offer page.

-

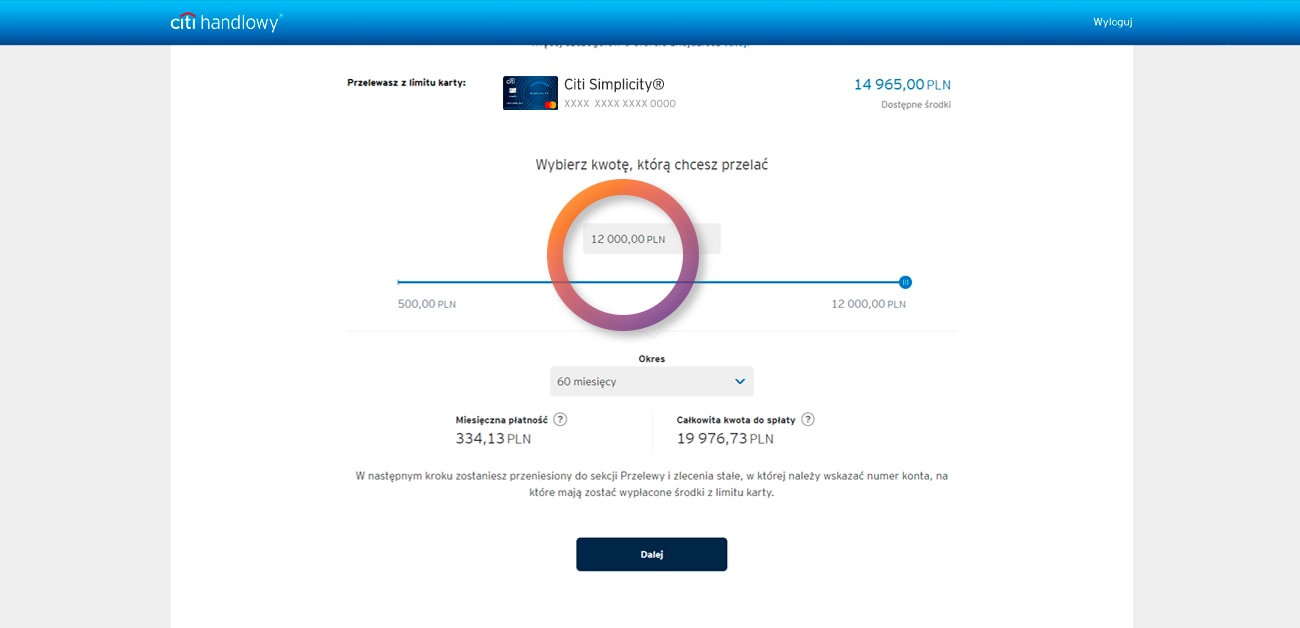

3. Select the amount and number of installments

Specify the amount you want to transfer from your credit card and the number of installments to be repaid.

-

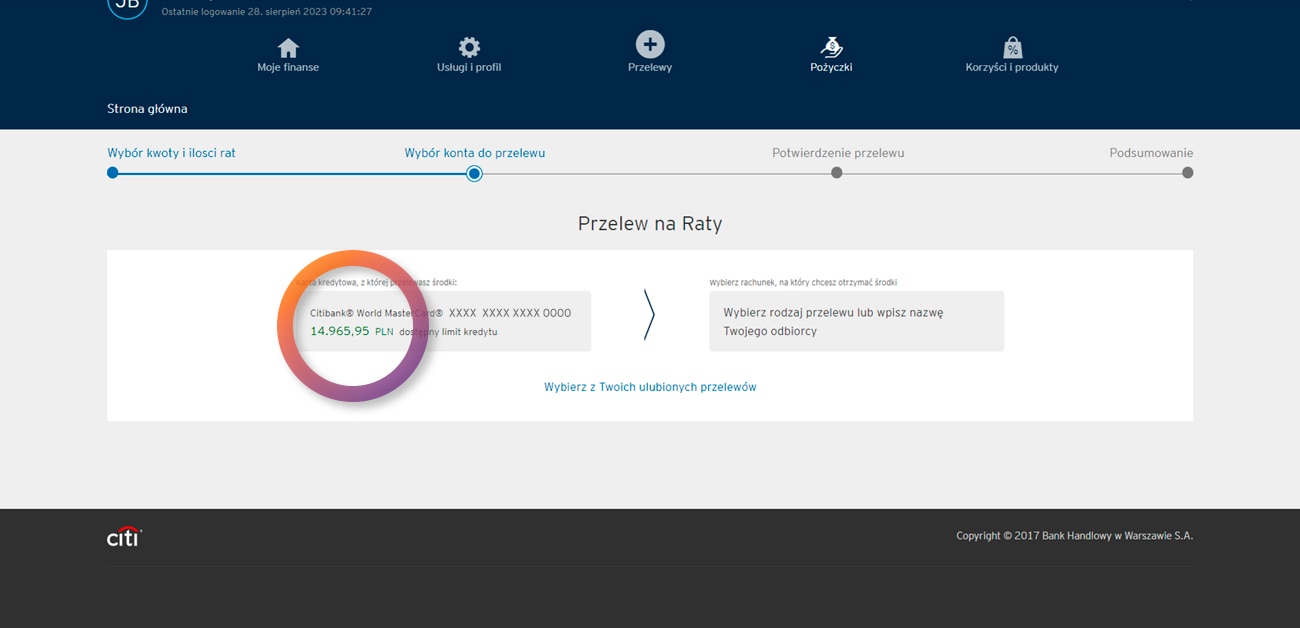

4. Select an account

Select the bank account to which you want to transfer funds.

-

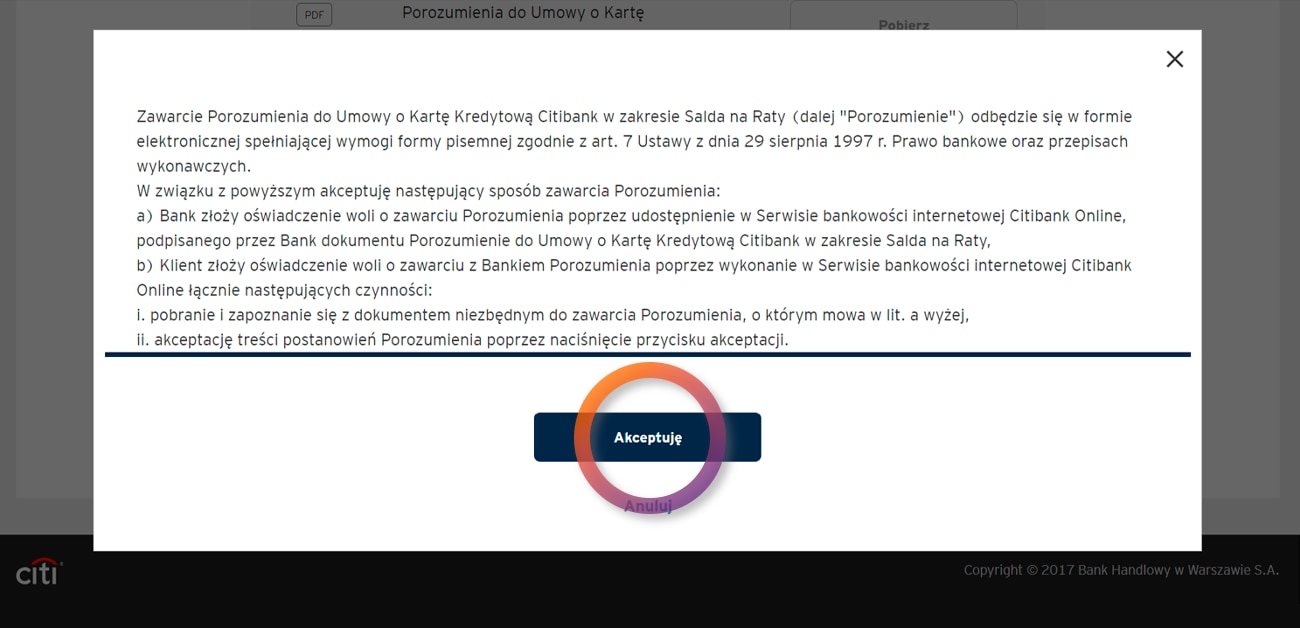

5. Confirm your details and enjoy your cash

Enter a one-time authorization code, confirm the data and accept (in the case of a transfer to your own account, the order does not require authorization with a code).

-

1. Log in to Citibank Online

-

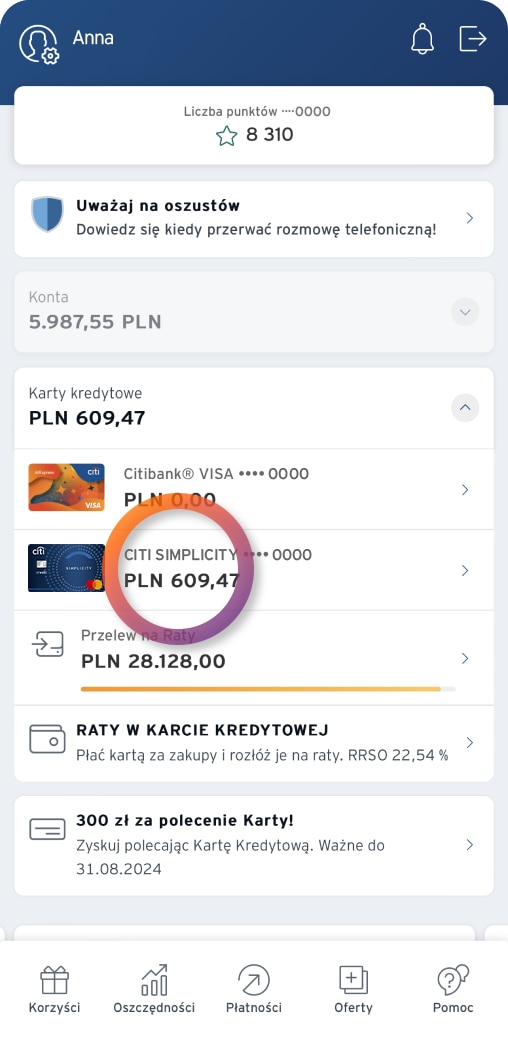

2. Choose the option "Quick Cash"

You will be redirected to the offer page.

-

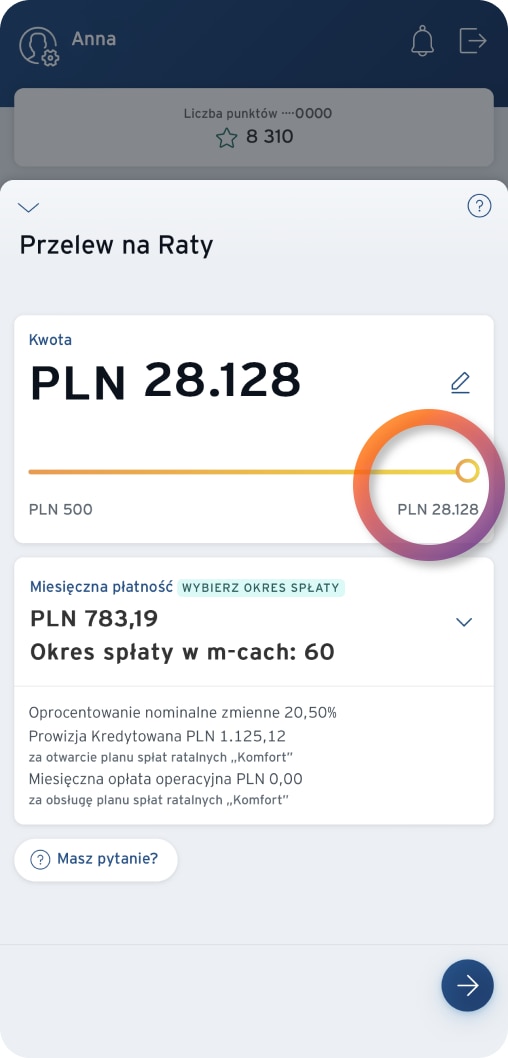

3. Select the amount and number of installments

Specify the amount you want to transfer from your credit card and the number of installments to be repaid.

-

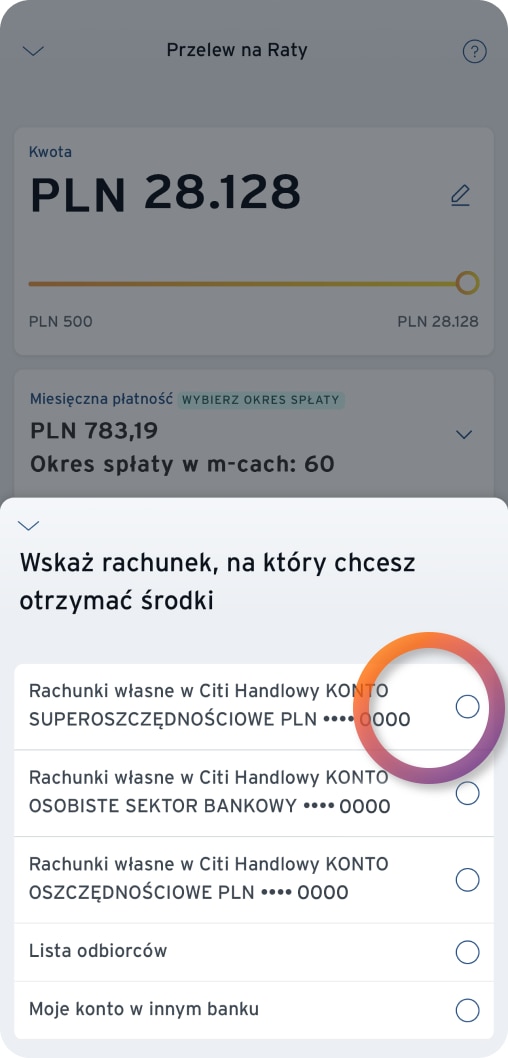

4. Select an account

Select the bank account to which you want to transfer funds.

-

5. Confirm your details and enjoy your cash

Enter a one-time authorization code, confirm the data and accept (in the case of a transfer to your own account, the order does not require authorization with a code).

Documents

Additional information

-

The most important features of the product

- You transfer a selected amount within the unused credit card limit to your account.

- Those borrowed funds can be available immediately (if you have an account with Citi Handlowy). And if you want them on an account at another bank we will send the transfer at once and the funds will land on your account within one working day.

- You will repay borreowed funds in equal monthly installments (“Comfort” Installment Plan). You select the number of installments (between 6 and 60) and their amount.

- Installments are shown on your credit card statement and included in the required minimum payment amount.

- The available credit limit is reduced by the borrowed amount. The limit will be renewed with every repayment made.

- Installments do not limit the possibility to enjoy the interest-free period on your card (56 days for cashless transactions). Interest is only charged on the amount of the Quick Cash (Przelew na Raty) and you may repay the other transactions entirely without any interest being charged on them

- At any time, you may change the number of installments, take additional funds or abandon repayment on installments.

- Interest is calculated on the declining balance of the outstanding principal amount.

- Depending on the offer currently in force, the bank can charge a commission for the opening of your “Comfort” Installment Plan and a monthly operating fee.

- The commission for opening “Comfort” Installment Plan is non-refundable in the event of repayment of the debt of the "Quick Cash" before the date agreed in the Agreement.

-

Representative example

-

Legal informations

EIR stands for Effective Interest Rate. Fees and commissions are charged in accordance with the Table of Fees and Commissions available on the website. Credit Card Regulations and the Table of Fees and Commissions for Citibank Credit Cards are available on the bank's website in the Documents section. The granting of a loan depends on the assessment of creditworthiness by Bank Handlowy w Warszawie S.A.

Bank Handlowy w Warszawie S.A. Citi Handlowy, Citibank and the Citi logo are registered trademarks of entities from the Citigroup Inc. group. This advertising material has been issued for informational purposes only and does not constitute an offer within the meaning of Art. 66 of the Civil Code.