Direct Debit

Integrated Receivables Processing

Direct Debit

Integrated Receivables Processing

Direct Debit is one of the most effective methods for collection of receivables from Payers. This advanced approach to settlements is recommended for all companies which have many customers making recurring payments.

Direct Debit – you should know that:

- documents required to initiate Direct Debit include: consents form (mandate) - an agreement between the Recipient (Client) and the Bank together with an authorization to charge the bank account signed by the Payer;

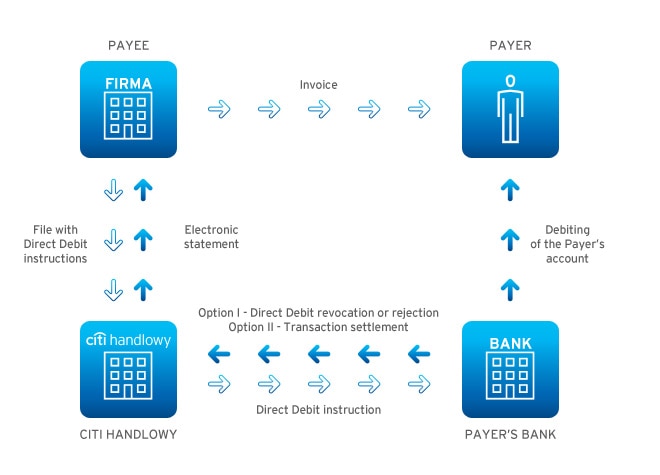

- Direct Debit allows you to reduce receivables collection costs and to assign control of proceeds to Bank Handlowy w Warszawie S.A., operating under the Citi Handlowy brand – it is the Recipient who initiates transactions and may send transactions electronically even a few weeks prior to their due dates;

- by 8:00 a.m. (D+1) the Client of the Bank receives full feedback, which may also include the reason for stopping a transaction;

- mandate to execute Direct Debit payments may be distributed electronically via the Ognivo system of KIR SA (interbank clearing house in Poland);

- Citi Handlowy is the only bank in Poland offering text notifications for Payers (Comfort Direct Debit).

Key features

- the only condition that must be met to start using Direct Debit, a mandate signed by the Payer is required to confirm his consent to charging the account under Direct Debit - such consent mandate will be delivered to the Payer by the Recipient

- transaction amounts are subject to no limits

- Payer has 56 calendar days to cancel (return) a transaction

- Payer may cancel a transaction even prior to the due date

- Payer may provide his consent via his bank

- Recipient may provide his consent via the Ognivo system

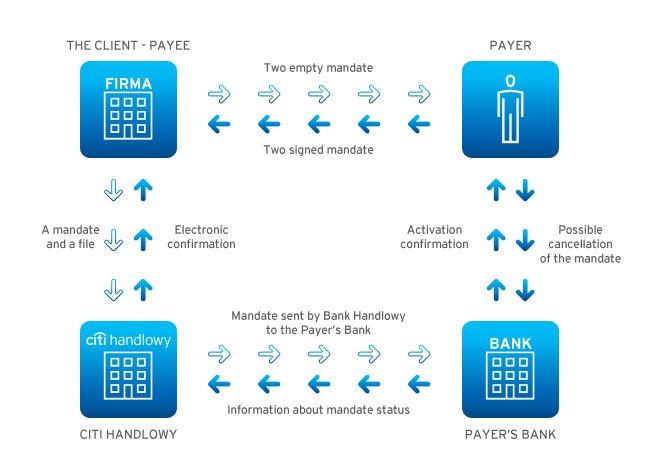

The Direct Debit process involves:

- Payer – an individual or a legal person

- Payer’s bank – a party to the interbank mandate

- Recipient

- Bank Handlowy w Warszawie S.A., operating under the Citi Handlowy brand

- the first step is made by the Recipient who sends to the Payer two consent mandates to authorize charges to the account

- after receiving the consent mandate the Payer should enter the number of his bank account into it, check the appropriate debtor status and sign the consent. The Payer’s signature on the consent mandate must comply with the specimen signature provided to the Payer’s bank to ensure that the Payer’s bank will not reject the consent on the ground of inability to identify the signature

- the signed consent mandates should be sent to the Recipient and the Payer’s bank

- after receiving the consent mandate, all subsequent payments will be executed as Direct Debits (you will hear of the service activation date from the Recipient).

Direct Debit security is guaranteed by:

- Payment Services Act of 19 August 2011 (consolidated text, Journal of Laws of 2011, no. 199, item1175)

- Banking Law of 29 August 1997 (consolidated text, Journal of Laws of 2002, no. 72, item 665, as amended)

- Interbank Direct Debit mandate of 1 June 1998, signed by all banks participating in Direct Debit settlements

- Regulations applicable to operations of KIR S.A. (interbank clearing house in Poland) (and especially to sending Direct Debits via ELIXIR – the nationwide electronic system for interbank data exchange)

- Execution in accordance with standards of Bank Handlowy w Warszawie S.A. – one of the largest banks in Poland.

In case of error in an executed Direct Debit (e.g. the charged amount was not as specified on the invoice received from the creditor) the Payer has the right to cancel the transaction. The Payment Services Act reads that such cancellation (return) must be not later than:

- 56 calendar days after the account was charged – for a natural person who does not run a business

- 5 business days for any other persons

| Time by which the Recipient may send a DD if it is to be executed on D+1 day | By 2:30 p.m. on the day preceding the DD execution date |

| Time by which the Recipient may submit a request to cancel a DD which is not executed | By 2:00 p.m. on the day preceding the activation date |

| Putting mandate in an envelope and delivering it to the appropriate office | By 3:00 p.m. on the current day |

| Consent status conmandateation by Ognivo | 3 business days |

| Consent status confirmation (by banks which are not Ognivo participants) | 7 business days |

| Files and mandate delivered by the Recipient by 11:00 a.m. | Import on the current day |

| Files and mandate delivered by the Recipient after 11:00 a.m. | Import on the next business day |

We are an active member of the Direct Debit Coalition, which is an association of mass bill issuers, banks and other entities, e.g. Krajowa Izba Rozliczeniowa (national clearing house). The Coalition has defined its mission as development and promotion of Direct Debit in Poland. The fact that the coalition participants have been cooperating in harmony for 11 years is the best proof that the widespread use of Direct Debit as a tool for payments for household bills is in the best interest of all parties – service providers, banks and end customers, i.e. Payers.

Are you interested in our offer?

Please contact CitiService Advisors.

CitiService Advisors are available Monday to Friday from 8.00 am to 5.00 pm.

The cost of the call depends on your local service provider.

Benefits

- fast and tested method for issuing Direct Debits – electronic transmission of transactions - CitiDirect

- possibility to sent huge volumes of transactions over a short time

- collection of receivables when due – settlements are made on a due date determined by the Recipient

- immediate access to funds in the account

- low costs of use and reduced administrative expenses of Direct Debit

- access to all details of executed Direct Debits

- fully automated process (also to re-submit transactions rejected because of insufficient funds)

- product implementation advice and optional training for the Client’s personnel

- output files in line with Client’s requirements

- a simple way to start Direct Debit (just sign the Consent)

- assurance that transactions will be executed on their due dates (it is the Recipient who is to keep an eye on deadlines)

- convenience and time saving (the Payer wastes no time as he does not have to submit orders, fill in mandates, ensure deadlines are met, etc.)

- option to cancel transactions after they are executed by the Payer’s bank - without providing any explanation

- due date notifications are automatically sent to the Payer

- account is charged exactly, and not sooner than, on the due date

- low costs charged by the Payer’s bank – usually at the standing order level

- option to re-submit a transaction in case of insufficient funds

Proposal for companies

Companies which opt for Citi Handlowy’s proposal may:

- avoid delays in receiving amounts due for delivered goods and services

- make inmandateation flows with contractors more efficient and deploy more sophisticated payment solutions

- improve their liquidity

- ensure receivables are paid sooner

- initiate payments electronically (i.e. avoid prolonged waiting for amounts due from their Payers).

Direct Debit was launched in Poland’s banking sector in June 1998. We were the first bank in Poland that sent a Direct Debit to another bank. The immense interest this payment solution had aroused among our Clients let Bank Handlowy w Warszawie S.A. to become the uncontested leader of the Direct Debit market. As Direct Debit is one of the most excellent payment tools, this settlement vehicle is expected to become even more popular in the near future.

For all inmandateation necessary to start using Direct Debit please visit websites of Bank Handlowy w Warszawie S.A.